I am a member of Social Venture Partners (SVP), an

organization that uses venture investing principles to support social ventures.

Founded in Seattle, SVP now has chapters all over the world. SVP Bangalore

celebrated its first “formal” anniversary last weekend.

SVP Bangalore Chair Akila Krishnakumar invited me to talk on

strategy for social investments. I had fun preparing for this talk, and decided

to use this opportunity to think carefully about the important question of how

to make impactful social investments.

I started by thinking of which social ventures have really

impressed me. I quickly zeroed in on Aravind Eyecare as one of the leading

candidates. Aravind founder Dr G Venkataswamy took an important problem

(hundreds of thousands of people suffering from unnecessary blindness due to

cataract), figured out a way of reducing the cost of cataract surgery by a significant

margin (a complete reconfiguration of the process to improve doctor

productivity and replace expensive doctor’s time by relatively inexpensive

paramedics’ time) and scaled it up in his own hospital. Another important

reason for success of the Aravind model is its sensitivity to the social

context – for example, they usually collect prospective patients from a single village

and bring them together with their families to the hospital since they realize

that an individual patient, on his own, is likely to be find the process scary.

But Aravind is not impressive just for this reason. Over

time, they have improved upon the original process in a spirit of continuous

improvement. They have been generous in sharing their model with others. And

they organize an annual conference where they and other eye hospitals exchange

ideas and best practices.

But, it doesn’t stop there. The Aravind model has been a source

of inspiration to others. Lifespring Hospitals uses Aravind’s principles in

maternity care. Dr. Devi Shetty’s Narayana Hrudayalaya has adopted elements of

the Aravind model in its efforts to cut the costs of cardiac care.

If I were to make a “social” investment, I would like to

make it in an organization like Aravind which has such widespread impact.

Giving this a conceptual shape…

Social investing, or impact investing as it is called by

some, has been around for about a decade. Along with strategic philanthropy, it

seeks to make a dent in major social challenges, particularly in the poorer

parts of the world.

Some recent research done by prominent foundations in this

broad space points to a framework for impactful social investing.

The Omidyar Network

The Omidyar Network has some insights that resonated with

me. They identify three important types of social enterprises – market

innovators, market scalers and enterprises providing market infrastructure.

Aravind would clearly be a market innovator, a social enterprise that created a

new model to solve an important social problem. However, Aravind is unusual in

that it has also been successful in scaling up the model and making it a more

generic solution to the problem. Often, this market scaling is done by a

different set of enterprises. Market infrastructure is a set of activities and

functions that is often needed by a sector to function effectively – e.g. a

credit rating service helps the growth of microfinance.

How are these relevant to the question of social investing?

Market innovators need risk capital and a willingness to support

experimentation. Some market innovators take a long time, as long as a couple

of decades to refine their models. So, they would clearly need some

philanthropic investments to sustain themselves. On the other hand, market

scalers may be more amenable to the risk-adjusted return metrics of more

conventional investing. Market infrastructure again because of its public goods

nature may need philanthropic capital.

I believe the importance of this market infrastructure is often

under-estimated. Take the case of low-cost medical devices as an example. With

the support of the Government of India’s Department of Biotechnology, Stanford

University, AIIMS and IIT Delhi offer a Stanford India Biodesign (SIB) Programme to train a new generation of innovators. In its first 5 years, SIB

graduated 24 fellows leading to 12 devices, 20 provisional patents and 5

products in trials. But there are major gaps in the ecosystem that currently

prevent SIB from achieving its full potential. The absence of independent and

credible testing, certification, distribution, and service support

organizations across the length and breadth of India impede commercialization

of the new medical technologies emerging from SIB. Social investing could help

create this critical market infrastructure.

The Omidyar Network makes another important point – it’s sometimes

necessary to support a large number of social enterprises in the same space in

order to provide the critical mass to help the sector take off.

Ashoka Foundation

The Ashoka Foundation is a catalyst for social entrepreneurship

and social innovation in a different way. They identify individuals who have

the potential to make a major impact and then support them as Ashoka Fellows.

The criteria Ashoka uses to select fellows are relevant to our search for

criteria for impactful social investing.

Ashoka has identified five pathways for an individual to

revolutionize a sector – (1) changing the market dynamics to include new,

previously excluded beneficiaries; (2) changing public policy or industrial

norms; (3) bringing about full inclusion of disadvantaged groups; (4) creating

a congruence between business and society; and (5) bringing about a culture of

change-making.

These change-makers (particularly categories 2 and 5) would benefit

from philanthropic investing because they often provide social benefits that

clearly have the characteristics of public goods. Here, I am thinking of

organizations like the Association of Democratic Reforms that have contributed

to improving the quality of our democracy by putting the spotlight on the

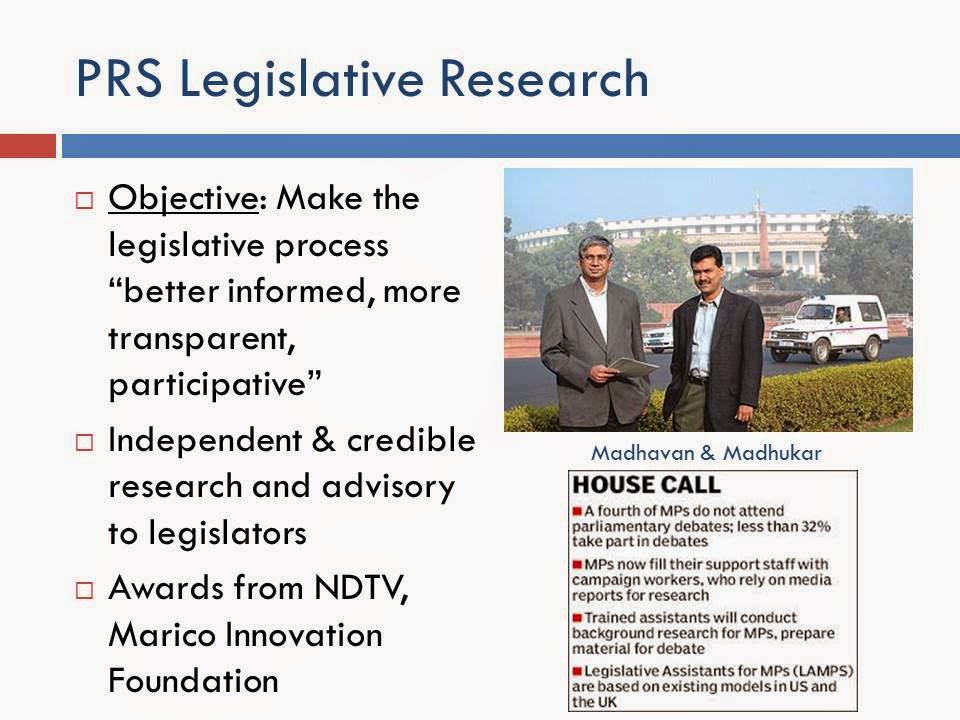

criminal records and assets of election candidates. Or, of PRS Legislative

Services that seeks to improve the quality of parliamentary discourse and

decision-making by briefing legislators on the consequences of impending

legislations.

Conclusion

Social (philanthropic) investors have a major role to play

in making social entrepreneurs successful. To make a large impact, the broad

consensus seems to be that they should look at sectors and not individual

organizations. They should identify and understand the nature of the problem

being solved. The nature of the financing required and the organizations to be

supported is linked to the gap/problem being solved. The effort of social

investors should be to accelerate the process of solving the problem – a study

by McKinsey suggested that accelerating the development of new low-cost medical

devices by even a few years could mean additional health benefits to a couple

of billion people in India. In doing so, they need to take an ecosystem

approach, realizing that innovators, scalers and infrastructure will all be

needed to make major impact.

[References: Matt Bannick & Paula Goldman, “Priming the

Pump: The Case for a Sector based Approach to Impact Investing,” Omidyar

Network, downloaded from omidyar.com on May 22, 2014; “How do you know when you

have revolutionized a field? Ashoka’s approach to assessing impact,” downloaded

from ashoka.org on May 22, 2014]

(The view expressed here are the personal views of the author.)

No comments:

Post a Comment